Bit Exchange, a leading name in the crypto trading arena, has just upped the ante by introducing XRP options trading. This strategic move is set to usher in a wave of flexibility and fresh trading strategies, allowing traders to harness XRP’s price dynamics like never before.

So, what’s the buzz about? Options trading isn’t your regular buy-and-sell game. It’s about buying the right but not the obligation, to purchase or offload XRP at a pre-decided price, all within a set timeframe. This means traders can now strategize around the future price movements of XRP, either to hedge their bets or to speculate on potential price surges or drops.

The decision to bring XRP options to the table wasn’t made on a whim. Bit Exchange has been sensing a palpable demand from both institutional bigwigs and everyday retail investors. The modern crypto trader is evolving, seeking more nuanced tools to navigate the volatile crypto waters. And with XRP’s popularity, the demand for advanced trading tools for the cryptocurrency was a no-brainer.

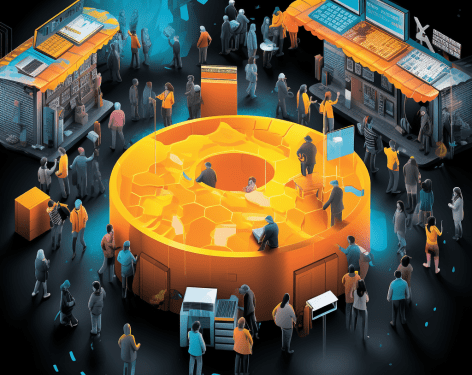

But here’s the thing about options trading: it thrives on liquidity and volume. And Bit Exchange knows this all too well. By introducing XRP options, the exchange is not just offering a new trading tool; it’s bolstering its platform’s liquidity and trading volume. More trades, more action, more dynamism!

Of course, with great power comes great responsibility. Bit Exchange is acutely aware of the regulatory tightrope it needs to walk. Ensuring that XRP options trading is in line with regulatory norms has been paramount. Plus, the safety of user funds remains a top priority, with measures amped up to ensure a secure trading environment.

In essence, Bit Exchange’s introduction of XRP options trading marks a pivotal moment. It’s a testament to the evolving landscape of crypto trading and the growing appetite for advanced trading mechanisms.